With headline figures hitting double digits in recent months (10.1% in July and 9.9% in August) and continuing the trend in September, inflation has become an increasingly topical subject and cause for concern over the last year.

After 25 years of low inflation being the status quo, we find ourselves in an extreme inflationary environment. This has mainly been down to the continual rises in the price of goods and services, some of which has been at record rates. The Bank of England continues to try and subdue levels through increasing interest rates, but this remains an ongoing battle.

How does this impact your retirement planning?

As variables go, inflation is one that can have a significant impact on retirement, whether you are a retiree or are in the process of accumulating wealth. Your assets will most likely need to grow or increase in value beyond inflation levels. Otherwise, the purchasing power of the money will decline, and you’ll be able to buy less and less over time.

For individuals in the accumulation phase, this means your potential retirement may require an increased amount of funding to ensure that your fund keeps pace with the increased cost of living. This becomes more of a priority if the underlying holdings within your investments are not outperforming inflation.

For retirees, increased prices may mean that you need to withdraw more income year on year, which will put additional pressure on your retirement pot. This could result in the funds being depleted at a faster rate than expected, and you might have to make certain sacrifices that ultimately impact your retirement objectives.

Income Strategy

Although there is no perfect solution, the income strategy employed in retirement can be structured in a way that helps mitigate the impact of inflation.

A good starting point is to ensure you are utilising the relevant tax allowances available, as this means you retain more of your money to use towards your retirement. This will involve knowing when and how to draw money from your investments alongside any other income sources. This is particularly important if you are on the cusp of moving into a higher tax threshold. It should also help avoid potentially selling investments and crystallising losses at inopportune times.

Speaking to a financial adviser is highly recommended when deciding on the most tax-efficient way to meet your income requirements in retirement.

Cash Holdings

Whilst you may feel that you need to hold more cash on deposit than usual due to the current environment, inflation tends to have the greatest impact on cash holdings, due to its historic low returns. Even with the recent increases in interest rates, the benefits are marginal. Whilst it is important to hold an emergency fund, I would be cautious of holding too much cash.

If you do happen to have surplus cash savings available, you could consider drawing an income from these holdings instead of your retirement pot. This should allow your portfolio further opportunity to outperform inflation.

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Mitigating the impact of inflation

An important consideration is ensuring that any existing investment holdings are suitably diversified to provide protection against the impacts of inflation. By doing so, you can help to ensure your portfolio is resilient and robust enough to continue to provide capital growth over the long term, regardless of the events and how widespread they are.

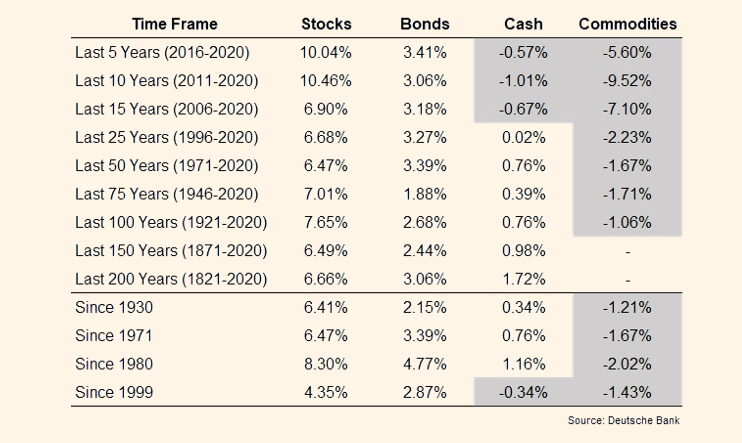

Investing and continuing to invest, offers the best potential to limit the impact of inflation. Past data demonstrates that most asset classes have outperformed cash over the long term. This is illustrated in the table below which compares real returns (after inflation) of US stocks, 10-year fixed interest, cash and commodities over 200 years.

Cashflow Planning

A useful tool that can be used to provide a clear picture of how inflation could impact your existing savings and investments is cashflow planning. It can forecast how long your holdings are likely to last, the impact of varying inflation and growth rates and how distinct assumptions alter the overall position. By mapping this out, you can assess and work with a financial adviser to determine whether you need to adjust your plan going forward. It can also be refreshed and re-worked to keep pace with ever-changing circumstances.

Long term view

Although it may seem quite dismal with the prospect of further price rises to come, history has shown us that these high rates tend to be transitory. The Bank of England data shows average CPI (Consumer Price Index) inflation over the last 100 years has been around 3-3.5%*.

Additionally, the current trend we are living through is considered as being an abnormal one, due to exceptional factors following the War in Ukraine and ongoing pandemic related influences. Although no one is currently in a position to say how long inflation rates will remain high, we believe we are close to, if not already at, the peak. Like everyone, we will have to wait and see if the contractionary monetary policy of rising interest rates takes more of a stranglehold as we move into 2023.

Conclusion/Summary

More than anything, this highlights the need to ensure you are working with a professional manager to help you understand what this really means for you and to ensure you are on the right track. Making sure your investment risk is commensurate to your needs and your assets are invested appropriately will be vital to withstanding the overall impacts of inflation.

Source:

Asset performance data – 200+ Years of Asset Class Returns (awealthofcommonsense.com)

Do you need help with your retirement planning?

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Financial Advisers to Work For

Finalist

Investment Performance: Balanced Portfolios

Finalist

Financial Planning Firm of the Year: Small to Medium Firm

Winner - Silver

Financial Planning Firm of the Year (Large)

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate