Request a call back...

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

Contact us today to discuss how we can help you…

Let us know how we can help…

Solent Business Park, 4500 Parkway, Whiteley, Fareham, PO15 7AZ

22 - 23 Old Burlington Street, London, W1S 2JJ

Suite 10, Branksome Park House, Branksome Business Park, Bourne Valley Road, Poole, BH12 1ED

Gostrey House, Union Road, Farnham, Surrey, GU9 7PT

Runway East, 1 Victoria Street, Redcliffe, Bristol, BS1 6AA

Queen Square House, Queen Square Place, Bath, BA1 2LL

Melbourne House, Wells, BA5 2PJ

2nd Floor, Dagnall House, 2 Lower Dagnall Street, St Albans, AL3 4PA

The Gallery, 1-3 Washington Buildings, Penarth, CF64 2AD

However, you envisage your retirement, we can create a bespoke plan for you. So you can enjoy the finer things in life…

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate

The Pensions and Lifetime Savings Association (PLSA) carried out extensive UK based research and concluded that an individual requires £37,300 per annum (p.a.) and a couple require £54,500 p.a. for a ‘comfortable’ retirement. A helpful steer but highly generic.

The first step then is looking at your unique personal expenditure with an adviser. They can help you determine how this might change when you retire and the level of income you might need.

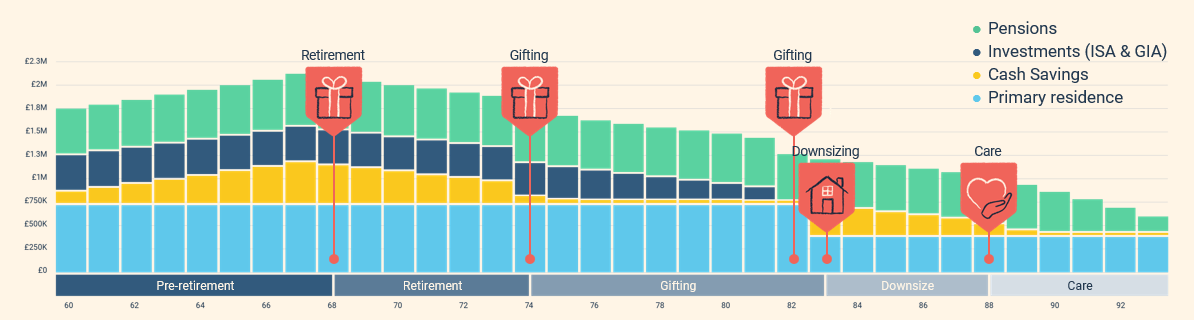

A cashflow plan has the potential to be life changing. Your assets, liabilities, regular saving plan and financial goals can be input into cashflow modelling software.

These can be overlayed with different assumptions such as expected investment growth, to help establish if you have enough money to achieve all your goals.

View an example cashflow plan

Scroll to view full image

One of the greatest applications of a cashflow plan is creating multiple scenarios, so that you can make informed financial decisions.

Want to know the impact of retiring at 60 versus 65, or the impact of downsizing? A financial adviser can provide the answer using this technology.

If you have multiple pensions, consolidating them into a single plan in preparation for retirement can be vital. Not only will it allow you to view everything in one place, but it will make managing your income straightforward.

Investing your money effectively prior to and throughout retiring is key. Expertise across a broad range of asset classes is important.

You will likely need to access your money through out retirement. Managing risk consequently becomes paramount to ensure you maximise your wealth whilst taking income.

Saltus Financial Planning is a ‘Chartered’ financial planning firm. It is a recognition provided to only a small number of firms that are at the forefront of our profession.

Achieving Chartered status means that we have met the highest standards for technical competence in the advice we provide to clients. It also demonstrates our dedication to continued professional development and shows that our clients are at the heart of everything we do.

We are specialists in retirement planning and have been helping our clients plan for retirement for almost 20 years. Not only do we have an award-winning team of advisers that are experts in cash flow modelling, but we also have some of the country’s foremost pension experts on the team.

We create a financial road map for our clients. Prior to investing, we can provide a clear recommendation on areas such as how much you need to save towards retirement, how much income you can take from your investments during retirement, how to minimise your tax burden and what return your investments need to generate to deliver on your plan.

As an independent financial planning firm, we are able to provide objective advice that is aligned with your best interests. We can offer the best of both worlds, either selecting from in-house investment strategies managed by Saltus Asset Management or from an alternative provider, depending on your objectives.

The Saltus Asset Management team have a long track record of producing superior risk-adjusted returns. This has been in part due to consistently identifying managers who outperform their benchmarks.

You’ll be working with a highly qualified financial planner to build and monitor your retirement plan. They have everything at their fingertips to provide what you might need to support your financial journey:

Our financial planning services can help you achieve your goals in life, whether it’s planning for retirement, consolidating your assets or investing your money…

Our specialists can help you prepare for retirement and provide ongoing advice once retirement has arrived. Get in touch to discuss how we can help you.

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

Watch the below testimonials from Saltus clients to hear what it's like to be one of our clients and how we have helped others like you...

We work with individuals from all walks of life and have a diverse client list consisting of people from professional backgrounds (including senior executives, entrepreneurs, lawyers, accountants, consultants and others) and non-professional backgrounds alike.

We typically work with clients with £250,000 or more in investable assets.

This has to be one of the most common questions we are asked as financial planners. The reality is that everyone is different. We’ll take the time to analyse what you spend now, and how this may change in retirement to help provide you with a precise answer. We have written an article on the subject, if you’d like to find out more

We work in partnership with our clients and can take care of all your needs in one place, all supported by industry leading technology.

As well as surrounding you with a team of highly qualified individuals, we have our own platform, can provide the tax wrappers you require, source investment solutions from the wider market or from our award-winning asset management team, and review your protection needs to ensure your family are looked after should the worst happen.

Once you have contacted us, we’ll have an initial discussion to understand more about what you are trying to achieve and how your existing assets and investments are structured. We’ll then have some further meetings to garner an in-depth understanding of your requirements and provide you with a report that outlines our recommended financial plan.

There’s no charge for the initial steps. As our plans are bespoke to your objectives, charges will depend on what’s recommended to you. These will be outlined in full before you progress with us.

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)

Winner

Best Financial Advisers to Work For

Finalist

Investment Performance: Balanced Portfolios

Finalist

Financial Planning Firm of the Year: Small to Medium Firm

Winner - Silver

Financial Planning Firm of the Year (Large)

Winner

Best Financial Advisers to Work For

Finalist

Investment Performance: Balanced Portfolios

Finalist

Financial Planning Firm of the Year: Small to Medium Firm

Winner - Silver

Financial Planning Firm of the Year (Large)

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

Contact us today to discuss how we can help you.

Alternatively, you can call us on 01489 663700 (Open Mon-Fri, 9am – 5pm)